What is a Rent to Own?

Our Rent-to-Own program aligns with our property management expertise by ensuring seamless tenant experiences, professional oversight, and a commitment to maintaining properties throughout the journey to homeownership. Rent to own is an alternative way to save for that forever or 1st time home. It allows someone who isn't necessarily ready to afford their house right now, but will be able to in the near future. When tenants go through this process they agree to rent the home for a set amount of time before exercising an option to purchase the property at the end of that time frame.

Who can apply?

If you have previously rented with AspirePeak Properties or are currently renting with AspirePeak Properties and your rental account is in good standing, then you can apply!

Don't worry if you have any of these:

-

Bad Credit

-

No Credit

-

Limited Down Payment

-

Irregular Income

-

New to Canada

Stop dreaming, apply now and together we can find a solution! Limited Spots each year.

How does it work?

AspirePeak Properties Ltd. has the ability to get you into a home of your choosing sooner. That's right, we go house shopping with you! This way we ensure that you will be purchasing a home you really love. This is essentially your home, meaning you will be responsible for all utilities and maintenance while renting. You are free to decorate your home how you want to, because in a few short years, it will be yours!

There are 2 agreements that are set up for a Rent to Own.

1. Traditional Lease

* This is where we specify how much your rent will be for the entire term of your lease (that's right, no rent increases) and how long your term will be.

2. Option to Purchase Agreement

* This is where we decide on the price you will buy your home for based on how much of a down payment you can afford.

Example:

You need 3 years to successfully complete your purchase. Your lease term and rent is then fixed from January 1, 2018 - December 31, 2020 for those 3 years. The purchase price of your home is set in advance on January 1, 2018 based off a 5% increase each year for general market inflation. Based off the purchase price of your home at the end of the 3 year term will dictate what your monthly option credit will be. This allows you the security needed when purchasing your home.

What is an Option Credit?

An initial "Option Consideration Fee" is required upon your application being approved for a home. This fee goes towards the down payment of your home. A minimum of 3% of the house price is required for this down payment option.

Along with the initial Option Fee, each month you pay a small amount on top of you rent which gets collected towards your final down payment, depending on what you can afford.

Step by Step Process

-

Fill out the online application & provide all required documents

-

Upon approval, we setup a meeting time to discuss timeline, budget and preferences for your home

-

The tenants sign a letter of intent and provide the Option Fee

-

We go house shopping together!

-

Once you and your family have fallen in love with a place, AspirePeak Properties purchases the home for you.

-

The Lease and Option to Purchase Agreement are signed by both parties.

-

Closing day arrives and you the tenants takes possession

-

Each year as part of the agreement we will have you check in with our preferred mortgage broker to ensure you are on the right path to purchasing & qualifying for your home at the end of the term.

Questions to ask yourself.

-

How much of a down payment do you have saved up and are willing to put towards the purchase of your home today?

-

Have you spoken with a mortgage broker to ensure that you are on the right track to obtain a mortgage in the future?

-

How long of a lease would you need to successfully complete purchasing your home?

Must Haves to get started!

-

A job (Full time, Part time or Self Employed)

-

A partial down payment saved. (Minimum 3%)

-

Desire to own your own home now!

-

Desire to go house hunting!

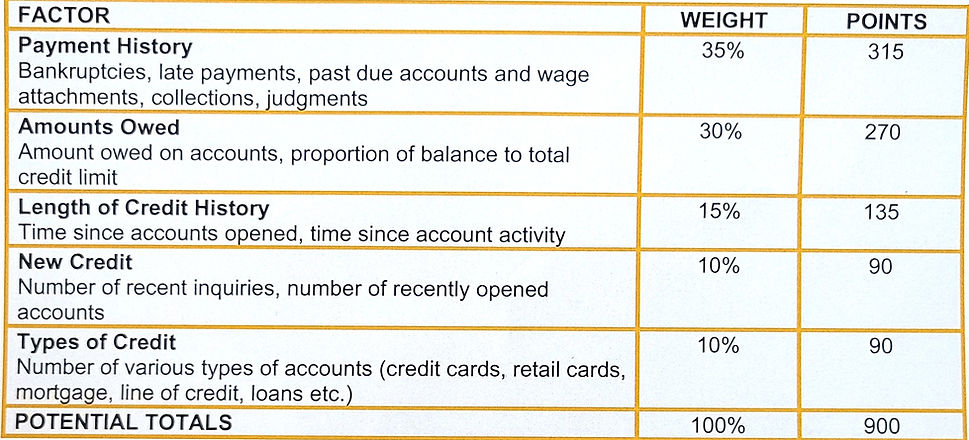

How your credit score is calculated

Here are some tips regarding your credit score and how they are calculated.

A score over 680+ is considered excellent and is now the minimum required score for a pre-approval of a mortgage with any "A" lender. AspirePeak Properties will report your on-time rental payments to Equifax while in the rent to own program helping to improve your score faster. Below is how your credit score is calculated & weighted with the credit bureaus.